The International Monetary Fund (IMF) has criticised the chancellor’s mini-budget again, just days after warning it will fuel the cost-of-living crisis.

The body, which works to create global financial stability, admitted tax cuts announced by Kwasi Kwarteng would lift economic growth in the short-term.

But it said the cuts would “complicate the fight” against rising prices.

It warned that “for many people 2023 will feel like a recession” with costs spiralling even further.

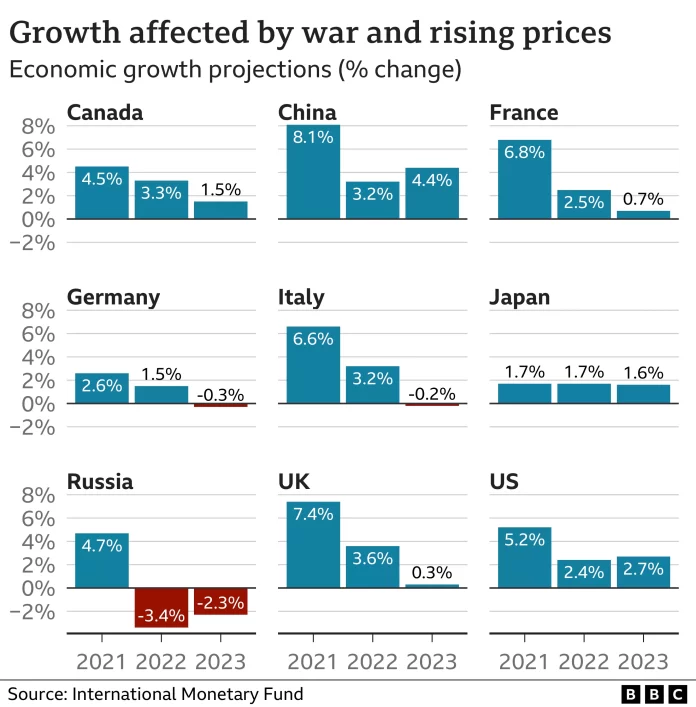

Economic growth in the UK is set to grind to a near halt next year, growing by 0.3%.

That marks a 0.2% downgrade from the IMF’s July forecast, and a sharp fall from the 3.6% rate of growth for the UK economy expected in 2022.

The most recent figures included in the new World Economic Outlook report by the influential financial institution do not, however, take into account the chancellor’s recent mini-budget.

The body, which works to stabilise the global economy, has also downgraded its economic growth forecasts due to the impact of Russia’s Ukraine invasion.

After Kwasi Kwarteng unveiled plans for huge tax cuts, the IMF criticised the government’s proposals warning that the measures are likely to fuel the cost-of-living crisis.

In an unusually outspoken statement, the IMF said the proposal was likely to increase inequality and add to pressures pushing up prices.

The IMF works to stabilise the global economy and one of its key roles is to act as an early economic warning system.

Five-member committee to lead IMF stakeholder engagement with financial sector

IMF begins analysis of Ghana’s ability to meet debt obligations

It said it understood the government’s package aimed to boost growth, but it said that the tax cuts could speed up the pace of price rises, which the UK’s central bank is trying to bring down.

In its latest report on Tuesday, economic counsellor Pierre-Olivier Gourinchas said: “As storm clouds gather, policymakers need to keep a steady hand”.

It acknowledged that that biggest tax package in 50 years set out by the chancellor would “lift growth somewhat in the near term”, despite the fact it sparked turmoil on financial markets.

It also added that the measures would “complicate the fight” against inflation, which measures how the cost of living changes over time.

The IMF also cautioned that governments would need to protect the least well-off from the impact of higher prices.

Poorer households often spend relatively more than others on food, heating, and fuel, it pointed out – all areas that have seen steep price rises as energy and grain exports have been restricted after the invasion of Ukraine.

And countries that are reliable on Russian gas in Europe are being hit particularly badly. Germany’s economy, for example, is now predicted to contract next year.

Meanwhile, Russia’s economy is expected to contract by 2.3% next year, the biggest fall of all the nations included in the projections.

Speaking on Monday, IMF boss Kristalina Georgieva noted that growth was also being dragged down in China by continued Covid restrictions, while in the US rising interest rates were “starting to bite”.

At the first in-person meetings between the IMF and the World Bank since the pandemic, she said countries could “reduce the pain ahead of us in 2023” by acting together.

She added that the IMF will be pushing for major economies to carry on with their efforts to bring down the cost of living, even if they have a negative impact on economic growth.

If they don’t do enough, she said, “we are in trouble. We cannot afford inflation to be a runaway train.”

She also said that measures should be “well targeted” to ensure they don’t push prices up even further.

Ahead of travelling to IMF meetings in the United States, the chancellor announced on Monday that he will bring forward his plan for balancing the government’s finances by almost a month to 31 October, in a bid to reassure markets.