The Center for Renewing America (CRA) filed two complaints — the first against Zuckerberg and his wife Priscilla Chan and the second against the groups Center for Tech and Civic Life (CTCL), Center for Election Innovation and Research (CEIR) and National Vote at Home Institute (NVAHI) — Thursday morning with the Internal Revenue Service (IRS).

The complaints, obtained by FOX Business, allege that Zuckerberg and the three groups were involved in a scheme to inject nearly $500 million into the 2020 election in order to “throw it” to President Biden. Biden ultimately defeated former President Donald Trump, winning key swing states Arizona, Georgia, Michigan, Pennsylvania and Wisconsin.

Zuckerberg hired former Obama campaign manager David Plouffe to spearhead the effort, according to the CRA. Plouffe allegedly funneled most of the hundred-million-dollar grants from the couple to Democratic-leaning jurisdictions in swing states via the three tax-exempt voting rights groups ahead of the November 2020 election.

DOJ seizes Team Trump phones as part of intensifying Jan. 6 probe

South Korean President Yoon’s profane reaction to Biden speech caught on hot mic

“It is beyond disgraceful to imagine federal taxpayers subsidizing the partisan preferences of billionaires who easily could have given to a Democrat super PAC in 2020,” the CRA said in a statement shared with FOX Business.

“But, of course, then they would not have been able to take a tax deduction, so they disguised the political nature of their donations and shuffled them through ‘charitable’ intermediaries, making ordinary Americans foot the bill,” the CRA continued.

The CRA noted that federal law prohibits individuals from making donations intended to illegitimately aid one political party over another.

The complaints said the IRS must deny any personal income tax exemptions collected by Zuckerberg and Chan for their donations to the CTCL, CEIR, and NVAHI during the 2020 election cycle. The CRA also requested that the IRS terminate the tax exemptions of the three groups.

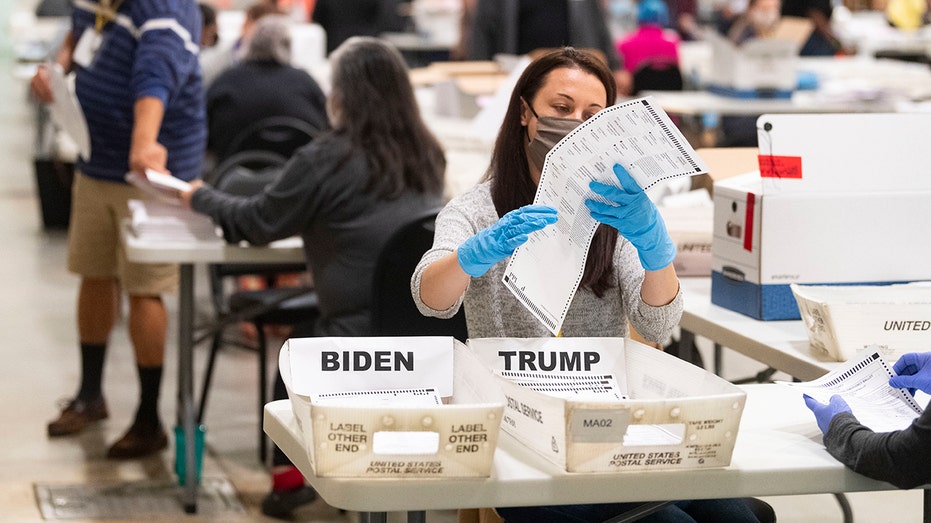

An election worker looks at a ballot during a hand recount of presidential votes on Nov. 15, 2020, in Marietta, Georgia. (John Amis/Atlanta Journal and Constitution via AP)

“We leave to the Service to determine whether there is enough evidence to sustain a criminal investigation into Chan or Zuckerberg for tax fraud,” the CRA complaint stated.

“Nevertheless, at the very least, it is incumbent upon the IRS to recoup what is likely a false tax deduction on a roughly hundred-million-dollar order of magnitude: an unlawful taxpayer subsidy running to support Democrat electioneering purposes.”